COVID19 has affected the entire world if we remove the obvious health concerns the virus poses, the biggest worry many people are now faced with is financial troubles. This has led to an interesting financial sector demand during COVID19 as both businesses and individuals seek advice and help to aid them during these difficult economic times.

TrustPilot data was collected to determine the demand across the various financial sectors for the months the pandemic initially hit in 2020 and cross-referenced with the same months in 2019 to identify growth between the two in both the UK and USA.

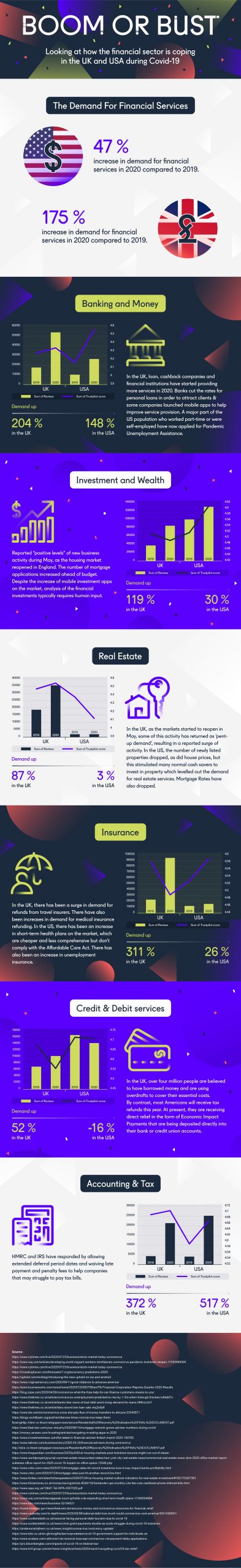

Both nations have shown a rise in demand for financial services but there has been a staggering difference between the two. In total, the UK has witnessed an increase of 175% compared to 47% in the USA.

With this sudden, unprecedented increase, financial providers swiftly had to adapt their services. Face-to-face appointments were no longer an option and as these services rely heavily on this, new procedures were brought in to help customers in the best way possible.

Contact centres were inundated with calls and some struggled to cope with this rise. Even the most traditional vendors have now come to realise the valuable asset of modern technology. Increasing self-service apps and websites has helped to ease pressure on call agents and utilising call centre technology, such as voice analytics, has aided agents to decrease average handling time while still providing the best customer service possible.

As more call agents began to work from home, possibly permanently, the support of colleagues and management was not as easy to access, therefore, every provision needed to be made to help call agents during this time.

We take a deeper look into each specific sector and the demand in the UK and USA.

Contents

Tax & Accounting

Both the IRS and HMRC responded to the pandemic with the allowance of extended deferral periods for payment and waiving many penalty fees to allow businesses and those who were self-employed to be able to survive through the first months of COVID19.

However, these rules are not always straightforward to those who are not accustomed to the regulations of financial reporting. Therefore, many reached out to current and new accounting firms to gain a professional understanding of these new terms and ensure everything is still processed correctly.

The UK saw a rise of 372% for tax and accounting firms, while the USA saw a whopping 517% increase.

Money & Banking

In the UK, banks and other loan businesses quickly provided a break period for many clients and holiday payments on loans, credit cards and even mortgages were offered to help those struggling financially during the pandemic.

Banks also cut rates on new loans to entice customers and increase revenue. Many also launched new mobile apps or updated features to improve service provisions.

The UK quickly took advantage of these offers and saw a rise of 204%, the USA saw a growth of 148%, reflecting the need to borrow but with fewer benefits in doing so during this time, demand was not as high within the UK.

Real Estate Services

The conveyancing process was placed on hold in the UK in March, completions were not allowed to take place and home viewings were out of the question. Despite this, the UK has seen a rise of 87% within real estate services.

An initial pause in the sector left a backlog of eager vendors and buyers and a surge for demand was seen when the market was reopened in June. This, teamed with the UK government eradicated stamp duty until spring 2021 meant there was a significant boom in the market.

The USA only saw a meagre 3% in growth, different states possessed their own regulations regarding home viewings and competitions, however, newly listed properties for sale became a rarity as homeowners were not willing to take the risk in selling during economic uncertainty.

Insurance

The UK has benefitted from The National Health Service for decades, whoever, the pandemic swiftly showed how stretched this free healthcare was and many who were awaiting scheduled procedures were placed on longer waiting lists as COVID19 patients were prioritised.

This led to many individuals seeking private health care, to both alleviate the strain on the NHS and ensure the best care possible for themselves for any condition, leading to a 311% increase in the UK.

The USA has seen a rise, but only 26%. Many Americans already have health insurance in place, those who did not are likely to have avoided this due to unaffordability and even with the threat of a pandemic, can not afford cover now.

It wasn’t just health insurance that presented itself as a reason for demand in services, travel insurance saw one of its busiest periods.

Typically, only a small percentage of holidaymakers will ever need to claim their insurance, however, with more holiday cancellations than ever, travel insurance companies have been inundated with claims.

Credit and debit services saw a rise of 52% in the UK but a drop of -16% in the USA. Investment and wealth noted an increase of 119% in the UK and 30% in the USA. With even more uncertainty ahead and a second wave hitting both nations, the financial sector is bracing themselves for higher demand with the possibility of even more losing their jobs and struggling with finances.

The Daily Buzz combines the pursuit of interesting and intriguing facts with the innate human desire to rank and list things. From stereotypical cat pictures to crazy facts about the universe, every thing is designed to help you kill time in the most efficient manner, all while giving you something to either laugh at or think about!