Many organizations have embraced the hybrid working model, where employees may work from home for some days of the week, if not most.

While this has proved beneficial for employees in terms of productivity and work-life balance, it has also opened up new opportunities for fraudsters.

Fraudsters can now target employees who are working from home, using various methods such as phishing emails and social engineering.

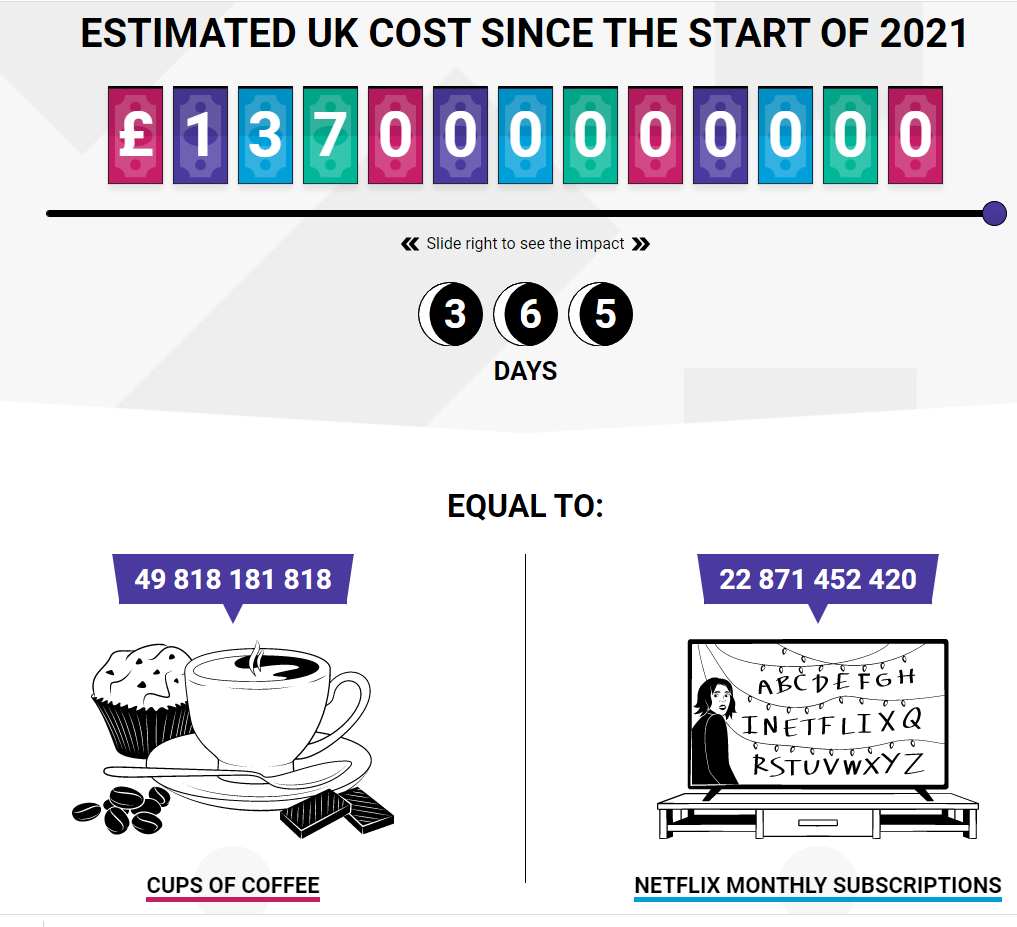

In 2021, the cost of fraud was approximately costing the UK economy over £137 billion.

As remote working has risen in popularity over the past year, it’s quite frightening that the cost of fraud is only going to increase even more.

Has Unsecured Wifi in Public Areas Caused an Increase in Fraud Because of Remote Working?

The increase in remote work has also led to an increase in the number of people using public Wi-Fi hotspots or having to use their phone as a hotspot to connect to their corporate networks.

From a survey created at the height of the COVID-19 pandemic, 43% of people stated that they had to use their mobile as a hotspot for connectivity.

Almost 38% of respondents revealed that an inferior internet connection had prevented them from being able to do their work.

This could then potentially lead people having to resort to vising local cafes or businesses to use their public WiFi network to work.

This presents a serious security risk, as it is relatively easy for cyber criminals to intercept data transmissions on public Wi-Fi networks, especially since data has suggested that 53% of people still used the same password across multiple accounts.

The Rise of Cashless Payments

The rise of cashless payments is another factor that has contributed to the increase in fraud losses.

According to the research, 63% of businesses across the pond have completely lost cash, while 22% have done so in the UK and 26% in the United States. In 2012, the volume of cash transactions stood at 20.8 billion.

Payment cards accounted for 10.5 billion transactions, while mobile wallets accounted for 304 million transactions.

Cash transaction volume in the UK grew at a compound annual rate of 13.7% from 2012 to 2021, with most payments now made via non-cash methods.

The trend of using credit and debit cards for everyday purchases has made it easier for criminals to commit fraud.

In addition, the use of online banking and mobile payments has also made it easier for fraudsters to access people’s bank accounts and steal their money.

However, this convenience comes at a price, as contactless payments are more vulnerable to fraud than traditional payment methods.

Conclusion

No doubt, the hybrid working model has its own perks, but it has also invited some serious challenges for organisations, one of them being the increased cost of fraud.

With more people working remotely, there is a greater opportunity for criminals to commit fraud.

If businesses want to protect themselves from the rising cost of fraud, they need to invest in security measures that can detect and prevent fraud.

Furthermore, businesses need to educate their employees about the risks of fraud and how they can protect themselves.

It is currently estimated that fraud will cost the UK economy over £137,000,000,000 in