Data has always played a key role in the insurance industry, and today insurance firms have an unprecedented way to more of it. That’s because humans have generated more data in the past two years than ever before.

Insurers are having to look at ways to apply predictive modeling and machine learning to maintain their competitive advantage, as well as to enhance business process efficiency to meet customer needs.

They are also looking at using the latest advances in artificial intelligence (AI) and machine learning (ML) to solve business problems across the insurance value chain, in other words artificial intelligence in insurance industry. It includes:

- Insurance and loss prevention

- Pricing

- Claims handling

- Fraud detection

- Sales

- Customer experience

Key Drivers of ML Development in Insurance

AI and advanced ML are amongst the top ten strategic technology trends currently being applied by top organizations to reinvent their markets in the digital age.

Key drivers for the adoption of AI and advanced ML in 2018 and beyond:

- Use of advanced technology

- Use of all possible data, including open source

- Monetization of data from the Internet of Things (IoT)

- Feedback opportunities

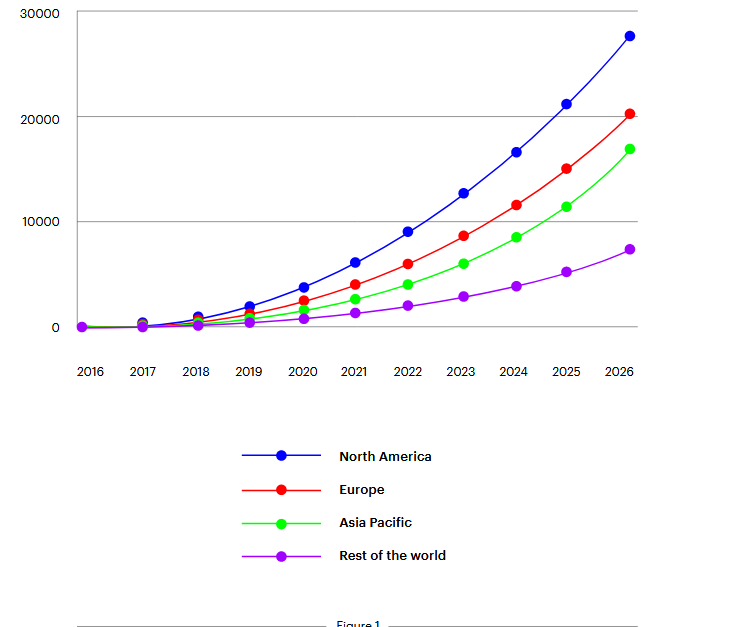

The chart shows the growth of the artificial intelligence and machine learning market in different regions over the 10 years.

It clearly demonstrates the increasingly rapid uptake of AI against the backdrop of the extreme relevance of this technological trend.

Challenges of Implementing ML

Most insurance companies recognize the value of machine learning for improving decision-making and optimizing business processes.

A 2018 Accenture Technology Vision study found that more than ninety % of insurers are practicing, planning to apply, or considering applying machine learning or artificial intelligence in their business processes.

These companies may face the following challenges in implementing machine learning:

- Technical requirements for machine learning neural networks

- Difficulties in finding and using a suitable data collection

- Difficulty in predicting profitability

- Data security

Conclusion

As rapid technological advances change the insurance industry, companies must become more customer-centric, improving service quality, creating better solutions to improve business operational efficiency, and building increasingly accurate insurance models.

Insurance companies have no choice but to implement machine learning. It’s necessary to stay competitive, deliver strong results, and drive business growth.

While machine learning used to be the exclusive domain of data scientists, commercial companies can now build data models and make accurate predictions faster. I

nsurers already have specialists in this area: actuaries, claims managers and agents who can contribute to machine learning projects.

As insurance companies consider implementing machine learning, they should look for any opportunity to automate all business processes as much as possible.

However, it all starts with a pilot model, which consists of developing a hypothesis, testing and analyzing the business benefits gained through machine learning and, once successful, scaling the technology.