I. Executive Summary

- Gene Hackman passed away in February 2025 with an estimated net worth of $80 million.

- Wealth sources: 40-year acting career, book royalties, and real estate investments.

- Post-2004, focused on authoring historical fiction and managing real estate.

- Estate complications arose due to the timing of his and wife Betsy Arakawa’s deaths.

- Highlights the importance of estate planning and legal clarity for high-net-worth individuals.

II. Introduction

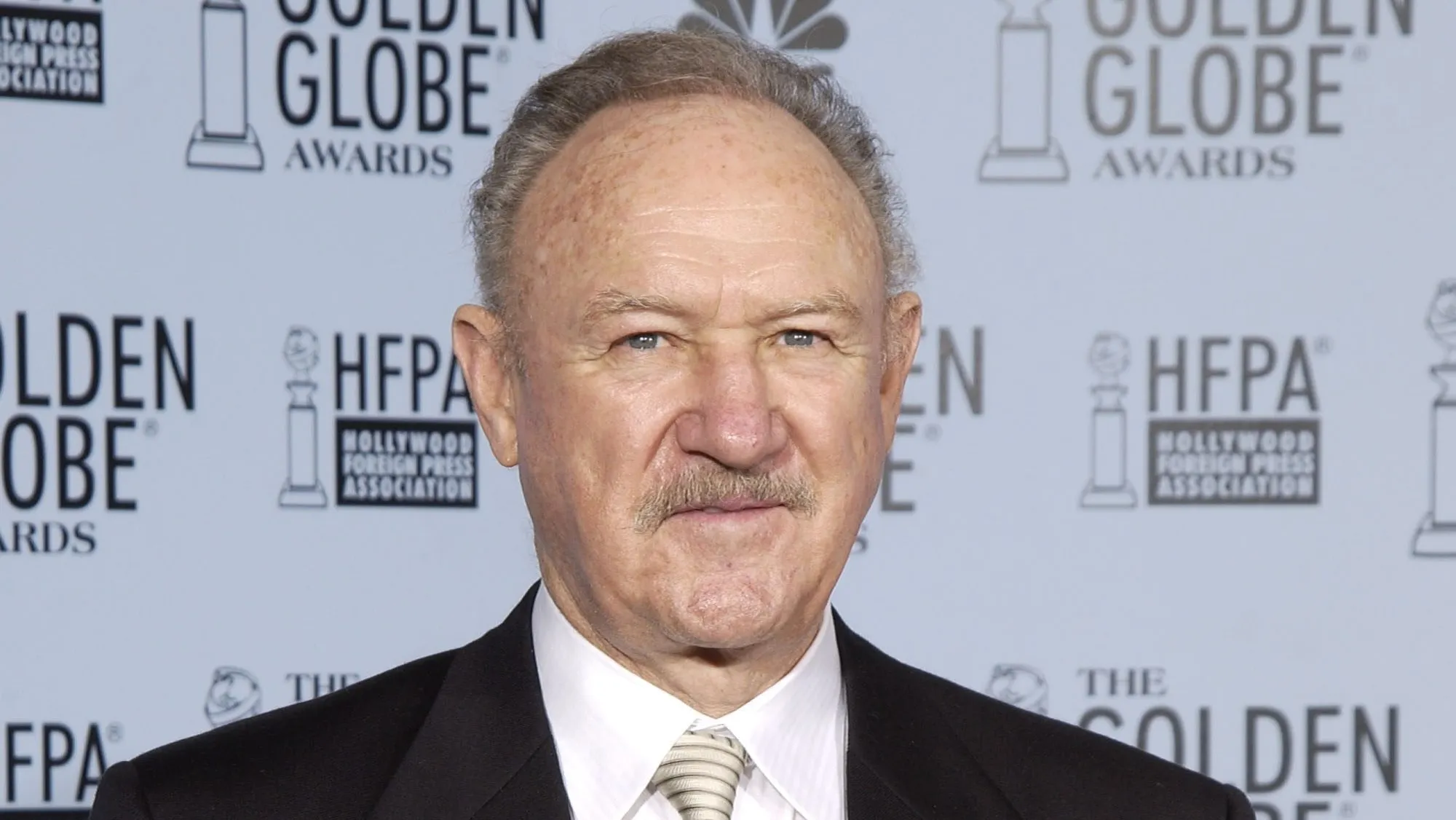

- Full Name: Eugene Allen Hackman

- Lifespan: January 30, 1930 – c. February 18, 2025

- Career Span: 1964 to 2004

- Awards: 2 Academy Awards, 4 Golden Globes

- Known for roles in The French Connection, Unforgiven, Superman, and Hoosiers

- After retirement, transitioned into a successful novelist and real estate investor

III. Estimated Net Worth

- Value: $80 million (2024–2025 estimates)

- Sources: Celebrity Net Worth, The Economic Times, Yahoo Entertainment

- Estimation Challenges:

- Largely private assets

- Unknown royalties

- Real estate holdings in private names

- Consistency Across Sources: Confirms general credibility

| Category | Value | Sources | Year |

|---|---|---|---|

| Estimated Net Worth | $80 million | Celebrity Net Worth, Yahoo, Economic Times | 2024–2025 |

| Main Income Sources | Acting, Books, Real Estate |

IV. Sources of Wealth

A. Acting Career

- Main contributor to wealth (1964–2004)

- Commanded multi-million dollar salaries by the late 1970s

- Adopted strategic contracts: backend deals, percentage of profits

- Balanced artistic roles with commercial hits

Key Film Earnings and Box Office

| Film | Year | Salary | Worldwide Gross | Notes |

|---|---|---|---|---|

| The French Connection | 1971 | $100,000 | $51.7 million | Best Actor Oscar |

| Lucky Lady | 1975 | $1.3 million | N/A | Major salary increase |

| Superman | 1978 | $2 million | $300.2 million | Highest single-film paycheck |

| Hoosiers | 1986 | $400K + 10% gross | N/A | Backend profit deal |

| Unforgiven | 1992 | N/A | $159.2 million | Best Supporting Actor Oscar |

| Crimson Tide | 1995 | $1.5 million | $157.1 million | Took reduced billing as a favor |

| Royal Tenenbaums | 2001 | N/A | $71.4 million | Not a money job; chosen for artistry |

B. Authoring Career

- Retired from acting in 2004, became novelist

- Published five historical fiction books

- Collaborations with Daniel Lenihan:

- Wake of the Perdido Star (1999)

- Justice for None (2004)

- Escape from Andersonville (2008)

- Solo works:

- Payback at Morning Peak (2011)

- Pursuit (2013)

- Revenue unknown but contributed to passive income

- Continued receiving film royalties after retirement

C. Real Estate Investments

- Portfolio estimated at $11 million+

- Key holdings:

- Santa Fe, NM: 8,761 sq. ft. home on 12 acres ($3.8 million)

- Honolulu, HI: Commercial-residential complex ($6 million+)

- New Mexico Land: ~$1 million

- Past assets:

- Montecito, CA estate (bought 1980, sold 1985 for $5.5M, resold 2015 for $25M)

- Pebble Beach, CA home (acquired 1993)

- All properties were in Betsy Arakawa’s name, raising estate complexities

D. Other Income Streams

- No known business ventures outside of real estate and authorship

- Not connected to Hackman Capital Partners (founded by Michael Hackman)

- Passive income:

- Royalties from classic films

- Book sales

- No known involvement in cryptocurrency or digital assets

V. Financial Legacy & Estate Planning

A. Death Circumstances

- Gene Hackman: Died c. February 18, 2025 (95 years old)

- Cause: Cardiovascular disease, Alzheimer’s complications

- Betsy Arakawa: Died days earlier of hantavirus pulmonary syndrome

- Both found in Santa Fe home on Feb 26, 2025

B. Will and Beneficiaries

- Last will (2005) named Betsy Arakawa as sole beneficiary

- His children (Christopher, Elizabeth, Leslie) were not included

- Estate handled by the Gene Hackman Living Trust

- Attorney appointed as trustee (not family member)

- Children reportedly had strained relationships with Hackman

C. Simultaneous Death & Legal Complexities

- Betsy’s will had a clause: if both died within 90 days, her estate goes to charity

- New Mexico’s Simultaneous Death Act: If two people die within 120 hours (5 days), estates are treated separately

- All real estate held in Betsy’s name

- Her will controls distribution

- If 90-day clause applies, major assets bypass Hackman’s children

- Emergency petition filed

- Appointed Avalon Trust LLC as temporary estate trustee

- Purpose: manage tax issues and notify potential beneficiaries

- Legal experts suggest Hackman’s children face an uphill legal battle

VI. Conclusion

- Gene Hackman’s $80M fortune was built on talent, strategic contracts, and passive income

- Acting career drove majority of earnings

- Post-retirement authorship and real estate secured long-term wealth

- Holding property in his wife’s name and the timing of both their deaths led to estate complications

- Trust and will decisions may result in his children being disinherited

- Estate now tied to legal interpretation of simultaneous death laws

- Case underlines the importance of updated and detailed estate planning for celebrities and high-net-worth individuals